Highlights:

- Revenue higher than last year thanks to Infra and Property development

- Rising profit margin in all sectors, good project results

- Property development & Residential building profit from current housing market

- Cash position has developed positively, H1 net cash € 44 million

- As a precaution, Heijmans sets aside a provision of € 34 million following negative ruling in Wintrack II case, appeal in preparation

- Gavin van Boekel to start as new CFO on 1 September 2021

Ton Hillen, CEO Heijmans:

“From an operational point of view, Heijmans can look back on an excellent first half of the year. I am proud that we managed to either equal or improve on last year’s results in all sectors. Heijmans’ earning capacity has improved steadily in recent years and is now at a robust level with a balanced risk profile. Focusing on the ratio of risk appetite to earning capacity remains our top priority.

It is precisely because of our excellent operational performance and our strong focus on risk management that I am deeply disappointed with the ruling in the Wintrack II case and the verdict of the judges thus far. The ruling of last May ensures that we prepare an appeal and we have decided to set aside a provision of € 34 million.

With respect to the outlook for the market as a whole, I remain optimistic. Although there are sub-segments that are affected by the nitrogen issue and Covid-19, I still see a lot of growth potential in the housing market, the energy transition and other segments. At portfolio level, we are in an excellent position to respond to the dynamics of the market and we will continue to seize these opportunities.”

Developments per segment

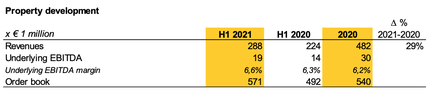

Property development

Property development made an excellent start to the year, with higher sales, rising revenue and result. For the second half of the year, we still are dependent on whether permits are issued for several larger projects.

Property development benefits from the pressure on the housing market. In H1, we sold 1,209 homes (compared with 1,075 in H1 2020), with the biggest rise in the number of homes sold to private buyers (873 in 2021 compared with 610 in 2020). In addition to its role as an integrated area developer of projects such as Den Haag Zuidwest, Utrecht-Overvecht and the Van Deysselbuurt in Amsterdam. Heijmans is also investing in land holdings for its own land bank, to make sure our portfolio continues to remain at a healthy level in the future.

Noteworthy projects in H1 2021 included Nieuw Kralingen (permit received), Greenville (high-quality project delivered), Vlaardingen Vijfsluizen (start of development and part of our Smart City strategy) and Zutphen Noorderhaven (110 apartments under construction). In H1, we also closed a number of agreements for new projects in Utrecht’s Leidsche Rijn neighbourhood (250 apartments) and the municipality of Hellevoetsluis (116 homes).

As a sustainable and climate-resilient response to the housing shortage, Heijmans teamed with a number of other market players to offer the Eemvallei Stad plan to the caretaker Minister of the Interior and Kingdom Relations. This unsolicited proposal foresees in the rapid development of a new town of 50,000 homes with new high-grade public transport links in combination with large-scale nature development, innovative agrarian businesses and the generation of sustainable solar and wind energy. Heijmans wants to use this project to help solve challenges such as the housing shortage, the energy transition, biodiversity, climate change and sustainable agriculture.

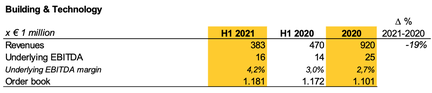

Building & Technology

Although Building & Technology saw its revenue drop by around 20% due to a decline in non-residential projects, profit remained at a comparable level. Like Property development, Residential building profits from the continued strong demand for homes. This translated into sharp price rises, which were visible in both house prices and cost prices. The Netherlands is proving unable to meet the ever-rising shortage of homes. This is due to a lack of planned areas and slow issuance of building permits. In addition to this, many workers have left the construction sector over the past few decades. We therefore expect the pressure on residential building to continue in the years ahead. And it is unavoidable that rising cost prices will be charged on to clients. The industrialisation of the building process will eventually offer a solution to providing affordable homes, but this will not happen in the near future.

We are cautious about taking on non-residential projects. We have noted that clients are somewhat hesitant about new investments as a result of the Covid-19 crisis and the ‘new way of working’. In addition to the pressure on the market for raw materials and other materials, we are faced with shortage of skilled workers. As we have often said, we have a selective acquisition strategy and believe projects require a good balance between risk appetite and earning capacity.

We have now fully delivered the New Amsterdam Court House (NACH), to the satisfaction of the client, and this project has now entered the operational phase. We have signed an agreement with the University of Leiden for the next phase of the Science Campus, with building due to start in September 2021. We also successfully delivered the Equinix Data Center in Amsterdam.

Heijmans Services continued to perform at a good level. Now that people are gradually returning to their offices, we are seeing the first signs that our service activities are on the increase. We note a rise in the number of requests for renovations and demand for our service activities is increasing.

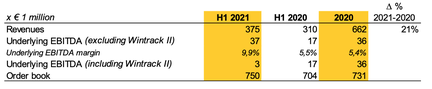

Infra

The Infra business delivered a strong performance and we saw an improvement in project results during execution. That helped us to increase revenue with more than 20%, also doubling the result.

In 2021, we expect Infra to outperform in terms of revenue and margin. In 2022, we expect the performance to be more in line with 2020, due to the absence of a solution to the nitrogen emissions issue and the resultant delays to tenders for larger projects. It should also be noted that, over the past few years, the focus in our order book has steadily shifted towards more asset management and maintenance work, making us less dependent on larger tenders. On the safety front, we are pleased to report that Infra is now certified for level 4 on the Safety Ladder, according to the model that assesses the degree to which the safety culture has been developed within an organisation.

Special projects in H1 included the widening of the A1 motorway at Azelo (almost completed) and the soil remediation in the Buiksloterham area in Amsterdam. Another noteworthy project was the large-scale renovation of the Polderbaan runway at Schiphol. On the waterways maintenance front, Heijmans won three great asset management contracts from the Ministry of Public Works and Waterways (Rijkswaterstaat), with the Vaarwegen Oost-Nederland, Zee and Delta Zuid and Zee and Delta Noord projects. Infra also received a permit for the Public Lighting and Digital Traffic Systems framework agreement. Heijmans is now responsible for maintenance of these systems in the Central and Southern regions of the Netherlands.

Financial results

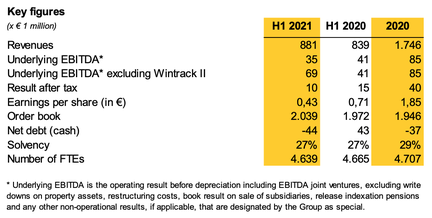

Revenue

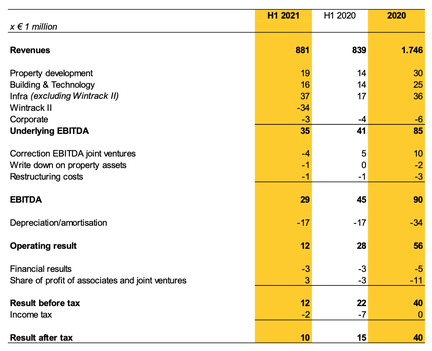

Revenue came in at € 881 million in H1 2021, compared with € 839 million in the same period of last year, which amounts to growth of 5%. Property development recorded the strongest growth, as both the number of homes sold and the rise in the house prices contributed to revenue growth. Infra also recorded solid revenue growth. Building & Technology recorded lower revenue, largely due to a decline in revenue from non-residential projects, which in turn was partly due to the completion of a number of large projects, including the New Amsterdam Court House (NACH) project.

Underlying EBITDA

The underlying EBITDA declined to € 35 million in H1, from € 41 million a year earlier. Excluding the provision set aside for the Wintrack II project, which is explained below, EBITDA increased to € 69 million. Infra in particular delivered a strong operational performance in the first half, driven by both higher revenue and very strong project results. We saw positive adjustments at a number of projects as they approached completion. The higher underlying result at Property development was primarily driven by the strong volume growth, but the margin also increased to 6.6% this year, from 6.3% last year. Building & Technology also recorded a rise in underlying EBITDA. Revenue may have been considerably lower, but the lower revenue was primarily in non-residential projects, and last year’s result was negatively impact by the major NACH project.

Windtrek II

Arbitrators have ruled that our client TenneT’s out-of-court dissolution on 6 September 2018 of the two agreements with Heijmans Europoles BV dating back to February 2017 was lawful.

The combination does not agree with this ruling. An appeal may result in the dismissal of this ruling. Although we are confident of a positive outcome to this case, out of prudence, Heijmans has included a provision of € 34 million in its 2021 first half results.

As stated in section 6.29 of our 2020 financial statements, this case is still subject to a raised level of estimation uncertainty. The contracts were for the design and construction of new high-voltage pylons for two transmission lines and involved a contract amount of around € 250 million. If it is found on appeal that TenneT’s out-of-court dissolution of the agreements was lawful, a subsequent damages procedure could result in a considerable outflow of resources, over and above the € 34 million we have set aside. To avoid interfering in the proceedings, Heijmans will make no further statements pending the arbitration.

Net result

The H1 net result fell to € 10 million in 2021 from € 15 million in 2020. The exceptional expenses were € 1 million higher than last year due to the depreciation of a land holding. The decline in the result was otherwise primarily due to the lower underlying EBITDA. For or a more detailed explanation of the tax position, please see section 7.5 of the selected notes.

Order book

The development of the total order book has been very stable in 2021, and it stood at a healthy € 2.0 billion at the end of the period. On balance, the order book increased by € 93 million in H1 and we noted a slight increase in all sectors.

Outlook

Driven by the strong operational performance in the first half of 2021, and even despite the above-mentioned provision of € 34 million for the Wintrack II case, for the full year 2021 we are on track to record a comparable underlying EBITDA to last year. Primarily at Infra and Property development, we expect to record an excellent operational result. As a result of the phasing of projects, and the fact that a number of projects have been completed, we expect revenue in the second half of this year to be slightly lower than in the same period last year. This means that total annual revenue will remain at a comparable level as in 2020. The net result will come in slightly lower than last year.

The outlook for Property development and Residential building remains strong for next year. We expect the volume of large Infra projects to decline slightly in the coming year, but we also expect to maintain the scale of our company by responding flexibly to opportunities in the market on the energy, sustainability, maintenance and water protection fronts.