Newcomers for a new perspective

Highlights

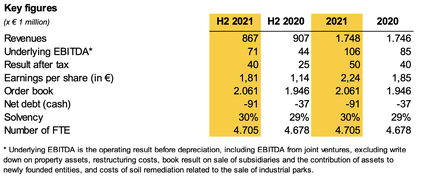

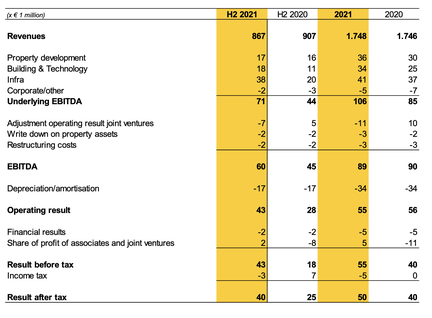

- Underlying EBITDA € 106 million on comparable revenue (EBITDA margin 6.1%);

- Net result rises to € 50 million in 2021, 25% higher than in 2020;

- Order book remains at a solid level of € 2.1 billion at year end;

- Balance sheet continues to improve: higher solvency (30.1%), robust cash position;

- Dividend proposal of € 0.88 per share (pay-out ratio of 40%);

- Outlook 2022: slightly higher revenue at comparable profit level.

Ton Hillen, CEO Heijmans

“Heijmans can look back on a strong performance in 2021. The net result came in 25% higher at € 50 million. All three business sectors contributed to our profit and since this year they all operated well within the bandwidth of our target margins, despite the limitations due to Covid-19. Heijmans continued to develop its earning capacity in 2021, which is currently at a robust level, with a well-balanced risk profile. I would like to express my appreciation for the flexibility shown by all our colleagues. This deserves a huge compliment. They carried on working, both on projects and at the office, despite the challenges thrown up by the pandemic. We also saw the number of accidents decline by 22%, and it looks like we have reached a tipping point.

As we move towards our 100-year anniversary in 2023, we are in a strong financial position. Factors such as the housing shortage, the energy transition and climate change are developments that have a major positive impact on the sectors we operate in. So it is imperative we continue our drive to become a better, smarter and more sustainable business. We are currently working on recalibrating our strategy, which will aim to address the major societal themes in the coming years to the best of our ability. While over the past few years we have focused primarily on people and profit, we will now put more emphasis on planet, adding sustainability and circular construction to our priorities. The first steps are already visible. On one hand, we have the prefabrication of wood frame homes, while on the other hand we have seen homes in concrete being made more sustainable thanks to conceptual building under the Heijmans Huismerk banner. And at Infra we are working more frequently with recycled concrete and asphalt. It remains our ambition to build in a CO₂-neutral manner in 2030.

Armed with a well-filled and high-quality order book, we are in an solid position for 2022 and we expect to increase revenues and whilst delivering a comparable level of underlying EBITDA. The government’s ambitions for the years after 2022 are quite promising. We are looking forward with a great deal of interest to see how these ambitions get translated into concrete plans that we can then realise together.”

Safety

Safety is our top priority and Heijmans makes no concessions on that front. The number of accidents fell by 22% in 2021. That is a good step, although we will only be happy when there are no accidents at all. The biggest challenge to achieving this goal is increasing safety awareness and safe behaviour. This is why we have decided that, in addition to embedding safety in the business at an operational level, we will position safety centrally in the organisation. We will coordinate safety across the business sectors, increasing know-how exchange, the sharing of best practices and the learning potential of the organisation.

In 2021, the Infra business sector achieved level 4 on the so-called safety ladder. This was thanks to the open and proactive way in which safety is discussed, as well as the commitment to increasing safety awareness via a programme for employees. Our ambition is to get all of our business units at level 4 after this year. The roll-out out of our innovative training course using virtual reality headsets was a big success. We will be expanding this programme in 2022. Externally, the 24/7 closure of the A12 motorway for nine days was a breakthrough moment. The Ministry of Public Works and Waterways (Rijkswaterstaat) opted for safety above a smooth traffic flow. In the subsequent evaluation of the project, the ministry was positive about the result. Heijmans is calling for this approach to be the standard for comparable projects going forward.

Safe working is also about cybersecurity. We have noted an increasing threat from phishing and ransomware. Heijmans has continuous IT measures in place to protect the organisation on this front, including an internal awareness programme for our employees focusing on safe online working.

Covid-19

Covid-19 had an impact on the entire year in 2021. Thanks to the ‘Let’s keep working, safely’ protocol for the construction industry, we were able to carry on working on our projects. This protocol is crucial for our business operations. Heijmans follows the relevant guidelines provided by the Dutch National Institute for Public Health and the Environment (RIVM) and we comply with these in a responsible manner. We also maintain an active dialogue with our employees, subcontractors, suppliers and clients on situations when this proves necessary. Thanks to these efforts, we can work safely and responsibly. That demands a lot from our people and we very much appreciate their dedication.

At an operational level, the impact of Covid-19 was visible both within the organisation and at our project locations. Despite this, not one of our projects was shut down and the financial impact of Covid-19 was limited. There were certainly financial disadvantages on certain fronts as a result of tightened measures, but there were also benefits. For instance, because our building sites were easier to access.

Outlook

Heijmans expects to record a slightly higher revenue in 2022. We are expecting to see growth at Property Development and Building & Technology, but as a result of the reduced level of major infrastructural projects, we expect revenue to decline slightly at Infra. On balance, we expect underlying EBITDA to come in at a comparable level to 2021. With a well-diversified order book at a stable level of € 2.1 billion, Heijmans remains in solid shape for the future.

The most important factor in the period after 2022 is whether we see ambitious government plans translated into concrete measures. This applies to both the nitrogen emissions problem (which primarily affects the infra sector) and the designation of new suburban development areas for new homes (which is relevant for our residential building and property development activities). The government has made a great deal of funding available for the energy transition and for society-wide measures to increase sustainability. The main challenge now is to add action and decisiveness to these financial resources.

At an underlying level, the outlook for our sector remains good, but we do need more concrete government measures to keep the supply of work in our sector at a stable level and to make sustainability investments profitable. While the sharp increase in raw materials prices and the continued high demand for labour and materials are significant points of attention, thanks to our stable order book and selective acquisition policy, we believe we will be able to prevent these developments from hampering our margins.

Heijmans remains in an excellent position to respond to growth markets, such as the maintenance market, the housing market and the flood protection market at Infra, plus the energy transition, which will have a major impact on all sectors. By putting customers first in everything we do, Heijmans is focusing on markets in which it can deliver the greatest added value, and by doing so optimising its margin potential in the future. This could include the likes of continued digitalisation of the construction process and the application of related business models such as data-driven services. But also the continued expansion of Heijmans’ in-house production in the form of woodframe homes, a path we took the first steps on in 2021 with the acquisition of our own production facility. The more the capacity utilisation increases here beyond 2022, the greater the role that woodframe construction will play in both improved margins and more affordable homes, but until that time the impact of this activity on our margins will remain limited.

Developments per segment

Revenue came in at € 1,748 million, which was slightly higher than in the previous year (2020: € 1,746 million). The first half of the year in particular saw a marked rise in volume.

Property Development

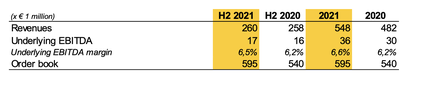

Property Development recorded strong results, with higher revenue and a 20% rise in underlying EBITDA compared with 2020. We were easily able to offset rising purchasing prices thanks to rising sales prices, which helped us to improve our margins. The number of homes sold, to both private buyers and to investors and housing corporations, increased substantially in 2021, coming in 18% higher than in 2020.

At Property Development, revenue increased to € 548 million in 2021 from € 482 million in 2020. The number of homes sold increased to 2,682 (2020: 2,265). Of the total number of homes sold, 1,162 (43%) were the result of transactions with housing corporations and investors (2020: 1,023). Sales to private buyers came in at 1,520 (57%), and were at a much higher level than the previous year (2020: 1,242). Driven by higher revenue that was largely a result of higher prices, the underlying EBITDA margin increased to 6.6% from 6.2%.

The property market is marked by continued tension between supply and demand. This is pushing up sales prices and putting pressure on the affordability of homes for residents.

In 2021, Property Development started with the development of an apartment complex concept. This is based on the same principles as the Heijmans Woonconcept (living concept) for houses: standardised variation in cooperation with fixed supply-chain partners, with consumers retaining flexibility in terms of options and look and feel within certain parameters. This helps us to build more quickly and more inexpensively. We are going to develop and build these apartments in Dreven, Gaarden and Zichten, the multi-year area development in The Hague.

What we are proud of is the national first of a park-inclusive neighbourhood. Maanwijk (Leusden) will be the first ever residential neighbourhood in the Netherlands to be an official part of the Utrechtse Heuvelrug National Park. Maanwijk will have 120 homes with the NL Gebiedslabel (area label) A, which makes the sustainability of the outdoor spaces measurable. We also measure the air quality, in collaboration with the University of Utrecht and the RIVM. With every one of our projects, we want to leave the environment in a better state than it was before we started the project.

In Rotterdam, we have started the construction of 295 homes in the Imagine project, which is adjacent to Feyenoord City. This is an example of building more sustainably: the apartments will be energy efficient, plus the building will be climate adaptive and comes complete with a shared inner garden. Residents will also be able to make use of shared mobility services. The consortium will also focus on the development and realisation of homes, commercial and social amenities in Rotterdam-Zuid, which will contribute to the overall development of the area.

Heijmans has signed a turnkey purchase agreement with an investor for the construction of 86 energy-neutral homes and two commercial spaces in the new neighbourhood New Brooklyn in Almere. We have signed a cooperation agreement with the Hellevoetsluis city council for the development and construction of 116 homes in the new neighbourhood De Boomgaard. If it is up to the city council and the consortium, phase 2 will see the construction of an additional 432 homes. Heijmans will be responsible for the construction of around 140 homes in this potential follow-up project.

The lack of planning capacity, the slow issuance of permits and frequently over-prolonged spatial planning procedures remain a challenge in the market. What is more, in the so-called Didam ruling (November 2021), the Dutch Supreme Court ruled that when selling land, local authorities must allow all (potential) candidates to submit bids. This means that local authorities are no longer simply free to sell land to a party of their own choosing. Local authorities now have to offer equal opportunities to all when they are selling land. If the Didam ruling leads to delays in the execution of municipal area plans, it is up to the local authorities themselves to catch up on those delays, Minister Hugo de Jonge said in the House of Representatives in January 2022. None of these obstacles are helping to accelerate housing production.

Building & technology

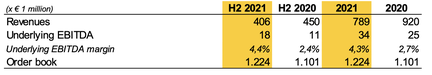

The biggest profit growth was recorded at Building & Technology, despite a decline in revenue. The year-on-year comparison shows a lower production level for non-residential projects, precisely the activities that recorded a strong improvement in margins in 2021. Revenue declined to € 789 million, a fall of 14% compared with 2020, but the underlying EBITDA rose 36% to € 34 million. This pushed up the underlying EBITDA margin to 4.3% from 2.7%, which meant that Building & Technology also achieved our target margin of 4-6%.

In 2021, Heijmans completed the renovation of the Dutch tax office at Laan op Zuid in Rotterdam. Thanks to a number of improvements, the office made some major advances in terms of sustainability and now has an A+++ energy label. Heijmans has started on the construction of the second phase of the Gorlaeus Gebouw, which is part of the Science Campus of the University of Leiden. This has a contract sum of € 71 million, with a focus on sustainability and flexibility.

In 2021, after a construction period of four years, we completed the New Amsterdam Court House. The NACH consortium now has a 30-year contract for the operation and maintenance of the building. At the Los Angeles Business Council Architectural Awards 2021, the court house was voted the best building in the Beyond LA category. In 2021, we also won an important contract in the field of integrated maintenance and management. Together with our client ASML, Heijmans and three other partners have put together a maintenance team that is set to enter a sustainable partnership with most of the chip machine maker’s Dutch production facilities. This multi-supplier model creates flexibility and will stimulate innovation and the joint development of solutions.

Last year, Schiphol extended our long-term cooperation deal with the airport. As Main Contractor, we will carry out maintenance projects through to at least 2025. We work on these projects as sustainably as possible, with a focus on reducing CO₂ emissions, partly through the use of electric-powered equipment. In addition to this, we have started to draw up a digital inventory of the airport’s physical business assets.

Infra

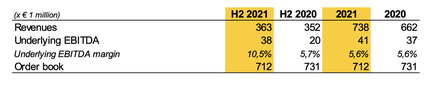

Our Infra sector had a very good year in 2021. Revenue increased to € 738 million from € 662 million in 2020. The 11.5% increase in revenue was realised with roughly the same number of people, while at the start of the year we were expecting a slight decline in revenue. In terms of revenue allocation, we saw a continued rise in revenue from recurring business. This involves smaller regional projects, specialisms and asset management activities. Major projects accounted for less than a quarter of Infra’s revenue.

Infra recorded an excellent result. Certainly if you take into account that, as a precautionary measure, we set aside a provision of € 34 million for the Wintrack II project in the first half of the year. In the second half of the year no adjustments were made. In a year in which Covid-19 was still clearly present and felt, we worked efficiently and recorded higher revenues. This resulted in higher project margins. Combined with outstanding project results and the absence of loss-making projects, this led to an underlying EBITDA margin of 5.6%. We expect a comparable margin level in 2022.

Our people showed their motivation and mentality in a completely different and very special way in 2021. When Limburg was dealing with floods, our colleagues with equipment spent their own time building dykes and other flood defences to help local residents. Heijmans is proud to have these people in our company.

In September, a section of the A12 motorway was closed completely for maintenance, which was a first in the Netherlands. In just nine days, we renovated the road in close cooperation with the Ministry of Public Works and Waterways (Rijkswaterstaat). This brief and full closure had a major positive impact on safety. For the first time, safety was prioritised over the flow of traffic. The ministry and the minister both judged the result to be highly successful.

In 2021, Heijmans completed the construction of the A1 motorway at Azelo. In a project commissioned by Rijkswaterstaat, we widened more than 40 kilometres of motorway in both directions between Apeldoorn and Azelo. We also completed the reinforcement of the Lauwersmeerdijk in the province of Friesland. This project involved fitting new cladding and a new profile along a stretch of almost 4.5 kilometres of dyke to mitigate the impact of climate change. This project was a part of the national Flood Protection programme. Heijmans also completed the Quebec project at Schiphol: this added a new aircraft bridge over the A4 motorway, to reduce traffic on the existing bridge. Thanks to this dual taxiway system at Schiphol, planes can now reach the runways on the western side of the motorway more easily and more quickly.

Heijmans is winning new contracts for waterways in the Netherlands. These include a major maintenance contract for the Zee and Delta-Zuid areas in the southern province of Zeeland. We have a five-year contact for the maintenance of rivers and canals in the eastern part of the Netherlands. Heijmans has also been selected for the design, realisation and maintenance of sound barriers along the A16 and N3 roads, next to the Amstelwijck building site in Dordrecht. These sustainable barriers are ‘green’, which will help increase biodiversity in the area. For a project on the Contactweg in Amsterdam, we are installing a dividing wall in a rail tunnel. The wall consists of 75% recycled concrete, which is another first in the Netherlands. The secondary materials are from our Buiksloterham project (also in Amsterdam). This is a pilot initiated by the Amsterdam city council, ProRail and Heijmans. This collaboration is a significant step towards a sustainable concrete chain.

Heijmans also delivered major renovation projects on the A6 (Flevoland) and A79 (Limburg) motorways. The biggest challenge in the major maintenance on the A79 was not the laying of 18 kilometres of new, quieter asphalt, but everything that happened alongside the motorway. This included the discovery of an archaeological treasure trove, potential unexploded bombs and a number of rare animal species. This is why the work was carried out in close consultation with various local authorities, the Ministry of Public Works and Waterways, provincial authorities, the local water board and an archaeological agency.

In 2021, Heijmans acquired the Nieuwegein-based underground infra specialist Verbree BV, a company that specialises in guided drilling and so-called curved drilling. This acquisition strengthens Heijmans’ position in the market for guided drilling. If we are to guarantee the energy supply, we will need to reinforce and expand the current electricity and thermal energy networks. This will increase the demand for more complex and more difficult drilling assignments.

On a national level, the Dutch government will have to devote more attention to the ageing road network, bridges and viaducts. We are seeing some worrying situations due to the poor maintenance of infrastructure works that date back to the 1960s and are now in urgent need of replacement. This will be a major undertaking and should not be underestimated. One clear example is the Haringvliet bridge. Aluminium plates that were fitted using clamps are being shaken loose by traffic. The government will have to invest more in replacement and renovation, to keep traffic flows – and, most importantly, safety - at acceptable levels.

Heijmans Energy

The Dutch government aims The Netherlands to be CO2-neutral by 2050. Everyone will have to contribute to this target, including Heijmans. We see the energy transition as a fundamental challenge, requiring comprehensive knowledge on subjects including area development, realisation and renovation of the built environment, and energy infrastructure.

Our organisation has this all-round expertise, and we want to use our innovative capabilities and scale to contribute to the energy transition in the Netherlands. Heijmans is running multiple energy projects to help develop the smart grids of the future. Last year, we launched the first actual projects, in which we will supply heating and cooling to two apartment buildings in Zutphen. Our comprehensive role is focused on design, construction, financing and long-term operation. The major issues in this sector are the transition from gas to sustainable energy and the increasing demand for e-mobility.

Strategy: Creating a healthy living environment

Heijmans works to create a healthy living environment every single day. Our ambition is to leave every location where we work better than how we found it. What this means is that all the activities in every project and department must ultimately contribute to this objective. Our three pillars of better, smarter and more sustainable provide internal direction for the achievement of our goals. The strength of our organisation lies in the professionalism and know-how of all our employees, and our collaboration with other partners.

As part of our efforts to increase our sustainability, Heijmans invested in the sustainability of asphalt transport via a participation in Millenaar & Van Schaik. This company is playing a leading role in the transition to sustainable asphalt transport. Besides the fact that all Millenaar & Van Schaik lorries are already running on biodiesel, in 2022 the company will be the first in the Netherlands to start using a dump truck running on hydrogen. The company has already ordered a number of these trucks. In collaboration with Volvo, the company has also developed a new, climate-positive five-axle lorry that is smaller than a traditional lorry with the same loading capacity.

Another good fit for our more sustainable pillar is our choice for in-house serial production of timber frame structures in an energy-neutral factory. Driven by our ambition to be climate-neutral by 2030, this is our next step on the path to circular and energy-neutral construction. The sustainability gains are immediately measurable, because the IIBO factory (acquired in December 2021) is 100% CO2 neutral. Timber construction is also 50% lighter than concrete. In the usage phase, this new generation of homes will generate sustainable energy equal to the amount being used. Wood is circular, so it contributes to creating a smaller carbon footprint over the life of the construction. Finally, timber frame constructions contribute to a healthy living environment. As an extension of that, Heijmans and Dutch forest conservation organisation Staatsbosbeheer signed a letter of intent in December 2021 to collaborate on a number of themes related to sustainable construction.

Challenges on the labour market

The pressure on the labour market, generally and in sectors where people work in technical field, is significant, and has been for a number of years. Generally, it is difficult in the Netherlands to encourage young people to start their careers in this sector, which is why Heijmans wants to keep emphasising that working in the construction and infrastructure sectors is an attractive option.

In light of this, we are happy with the engagement and satisfaction of our current employees. In 2021, we conducted a company-wide employee engagement survey, in which 83% of our employees participated. The eNPS (employee Net Promotor Score) went up in every component, and came in at +25 across Heijmans. This is well above average, both in the sector as in general. We aim to be the best employer in the construction industry, and we are pleased that our colleagues want to contribute and participate. For example, we saw a lot of interest in the Works Council elections in 2021.

Heijmans has a zero tolerance policy for unacceptable behaviour, such as bullying, discrimination, sexual intimidation or inappropriate sexual conduct. Employees have access to confidential advisers, and we investigate every report. If necessary, we take appropriate measures. We create an environment where this can be discussed, by hosting integrity sessions and drawing attention to our confidential advisers. This is not just about unacceptable behaviour, but is also intended to create a positive working environment at Heijmans.

This summer, thirteen participants in the program for refugees with residence permits became Heijmans employees. They started a vocational training course in 2020, guided by specialist firm Temphory. They were assigned internal buddies from a programme running in parallel, to help them navigate our organisation. We are continuing this project, and we are planning to add more refugees with residence permits in 2022. Many Heijmans employees have expressed an interest in acting as a buddy and guiding aspiring colleagues.

In September 2021, we started a training programme with 48 participants, a large number of whom were already active within Heijmans as graduates or interns. In order to attract new talent, we launched the ‘Experience Heijmans’ campaign. A social media video campaign, with an influencer who is popular among young people, reached a significant audience with a message of enthusiasm for working in a technical field.

Financial results

Revenue and underlying EBITDA

Heijmans recorded revenue of € 1,748 million in 2021, roughly the same as in 2020 (€ 1,746 million). This was higher than expected, because Infra saw its revenue increase by 11.5% when we were expecting a decline. Building & Technology saw its revenue decline due to fewer non-residential projects and a cautious acquisition policy. Our property development and residential building operations showed growth as expected, primarily as a result of rising housing prices.

Underlying EBITDA improved to € 106 million in 2021, compared with € 85 million the previous year. Underlying EBITDA improved in all sectors, both in terms of absolute numbers and in terms of margins. Infra performed particularly well, because this margin growth was paired with our precautionary measure of recognising a provision of € 34 million on the Wintrack II project in the first half of the year. Heijmans aims for an underlying EBITDA margin of 4% to 5.5% for all its production or construction activities, and 6% to 8% for its property activities. In 2021, all activities met these target margins, with Infra clearly at the top, as a result of excellent project results without any significant loss-making projects. In recent years, we have increasingly managed to make sure we are in control of projects, improving the bottom line results and increasing predictability. Covid-19 had a limited impact on our financial results in 2021.

Non-operational items

Restructuring costs coming from qualitative organisational adjustments (€ 3 million) and movements in several property investments and land holdings (on balance, minus € 3 million) had a limited impact on Heijmans’ operating result. Heijmans regularly assesses its property investments and land holding on the basis of the prevailing reporting rules. This resulted in € 3 million in value adjustments on several holdings, as the underlying development plans have either been delayed or are now seen as less promising than initially thought.

The most material non-operational item pertains to the impairment of the asphalt plants in connection with the recent benzine emissions issue. Due to the fact that these plants have been incorporated in the AsfaltNu joint venture, you can find more information on this item in result from associates.

Financial income and expenses

The balance of financial income and expenses was minus € 5 million in 2021 (2020: minus € 5 million). Both interest expenses and interest income came in at a comparable level to the previous year and Heijmans did not draw on its syndicate loan at all last year. As a result of higher cash and cash equivalents and the negative Euribor, Heijmans paid more interest. Interest expenses consist of project financing, capitalised fees and costs for the availability of credit, negative interest on cash reserves and the interest expense for lease obligations that result from the application of IFRS 16 ‘Leases’. Interest income pertains to loans granted.

Result from associates

The (net) result from associates deviates quite strongly from the adjusted result (EBITDA) joint ventures due to the fact that the AsfaltNu joint venture was subject to an impairment of € 5 million. This joint venture incorporates the jointly held asphalt plants of Heijmans and Royal BAM Groep N.V. This impairment was due to changes in the financial outlook, as this joint venture will now require additional investments to recycle asphalt according to prevailing standards, after the plants exceeded benzeen emissions standards.

Taxes

The tax rate was 8% in 2021, much lower than the nominal tax rate of 25%, but significantly higher than in 2020 (0%). This was largely related to Heijmans’ increased profitability and outlook for the years ahead, due to which previously unrecognised tax losses from the past have now been recognised. The impact of this was € 11 million. Following this upward revaluation of tax assets, the remainder of the unrecognised losses is limited (€ 19 million, with a potential rounded-off valuation impact of € 5 million). Heijmans therefore expects the tax rate to trend upwards, ultimately to the nominal tax rate.

Net profit, cash flow and dividend

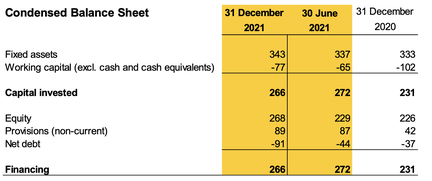

The net profit for the full year 2021 came in at € 50 million, a rise of 25% compared with 2020, when Heijmans recorded net profit of € 40 million. The rise in net profit was in line with the rise in underlying EBITDA, while it was dampened somewhat by the higher tax rate. Cash flow was also strong again in 2021. In addition to the strong financial performance, Heijmans’ operating cash flow was driven by strong working capital development, while the collection of receivables and work in progress remained at a solid level, although we did see a decline in property-related inventories. Heijmans’ net cash position improved by € 54 million in 2021 to a € 91 million net cash position (2020: € 37 million).

As a result of its strong operating cash flow, Heijmans made no use of its syndicated loan during 2021. Heijmans’ solvency has improved over the past few years, despite the introduction of IFRS 15, IFRS 16 and the buy-in of its pension fund, and stood at 30.1% at year-end 2021. In view of the company’s strong balance sheet ratios, Heijmans has decided to propose a dividend payment of € 0.88 per share. This corresponds with 40% of the realised net profit and is therefore in line with the intended pay-out ratio stated in Heijmans’ dividend policy. Shareholders will be offered the choice between payment in the form of a stock dividend or a cash dividend.

Equity and financing

Equity increased by € 41 million to € 268 million in 2021. On top of the addition of the realised net profit of € 50 million to reserves, shareholders' equity declined by € 4.6 million as a result of adjustments to actuarial results and the concomitant tax effects that are booked directly through shareholders' equity. In April, Heijmans also issued over € 3 million in ordinary shares and placed these with the holders of the class B cumulative preference shares in line with the agreement to pay out the dividend coupon on these preference shares in the form of ordinary shares and then to use the pursuant cash savings for the redemption of the class B cumulative preference shares. Finally, shareholders’ equity declined by € 7.6 million as a result of the payment of a cash dividend in April. The remaining part of the total dividend payment of € 16 million was paid out in the form of a stock dividend.

Heijmans’ net cash position stood at € 91 million at year-end 2021. This was the balance of cash in hand and € 31 million in cumulative preference shares, € 74 million in leases and several limited project financing amounts. Heijmans made no use of its syndicated loan in 2021.

In April 2021, Heijmans’ € 117.5-million syndicated loan was renegotiated and extended by one year through to year-end 2025. The terms were improved on several fronts, including reduced interest margins. The interest margins were also linked to a number of sustainability ambitions.

The condensed balance sheet as at 31 December, on the basis of invested equity, can be specified as follows:

This makes it clear that the improvement in the net interest-bearing debt is primarily due to the lower working capital and a rise in shareholders equity. Below you will find a more detailed explanation of the various main components of our balance sheet.

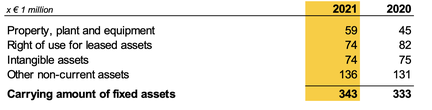

Capital invested: fixed assets

The composition of the fixed assets can be specified as follows:

Property, plant and equipment pertains primarily to buildings and sites, machines, installations, large-scale equipment and other property, plant and equipment. In 2021, investments amounted to € 26 million (2020: € 16 million). In addition to regular replacement and expansion investments in equipment related to our continued sustainability drive, Heijmans also invested in the acquisition of the specialised drilling company Verbree BV and the acquisition of IIBO’s wood frame production facility. The other fixed assets are largely related to Heijmans’ participations in joint ventures.

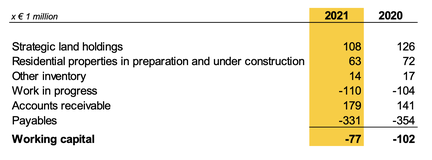

Capital invested: working capital

Working capital stood at -/- € 77 million at year-end 2021 (2020: -/- € 102 million). The working capital utilisation of Heijmans’ building operations (i.e. the non-property development-related activities) is primarily driven by the speed of invoicing, as well as the speed at which outgoing invoices are paid. It is possible to ascertain the speed of invoicing from the item ‘work in progress’, which is found on both the asset and liabilities sides of the balance sheet. If this shows a credit position – on balance – this indicates that projects are pre-financed by clients across the entire Heijmans group. This is something Heijmans expressly strives for during order intake and Heijmans achieved a pre-financed position for the full year 2021.

Total pre-financing increased by € 6 million and Heijmans remains – on balance - pre-financed at an acceptable level. Over the past few years, the average receivables term has been shortened considerably and this effect was also visible in 2021. Due to the high invoicing level in December, receivables increased by € 38 million, which means this effect was not directly visible in the end of year balance. We also expect the negative Euribor on bank balances to play a role on this front, as clients are increasingly paying more quickly than the agreed payment term. Outstanding payables declined by € 23 million. Heijmans’ inventories (land combined with homes under construction) declined by € 30 million, which is explained in more detail below.

The composition of working capital can generally be specified as follows:

Although working capital fluctuated a good deal in the year under review, over the past few years Heijmans has managed to make its activities and the concomitant impact on working capital less season-dependent and volatile. Heijmans’ working capital requirements are largely project specific and related to our clients’ payment schedules. The seasonal influences in the construction industry are due to higher activity levels in the second and fourth quarters (largely on account of lower production during the winter and summer months), as well as a higher level of notarial transfers and (claim) settlements of extra work prior to balance sheet dates. Higher capital requirements in the course of the year result in higher capital utilisation, which Heijmans could supplement if this proves necessary by making use of its revolving credit facility.

Capital position

The order book for the entire Heijmans group stood at € 2,061 million at year-end 2021 (year-end 2020: € 1,946 million). This increase was driven mostly by Property Development and its related home building activities. The order book for Infra and non-residential projects remained at a stable level. The quality of the order book also remained stable.

As Heijmans focused less on large, integrated projects, the structure of the order book has become somewhat more short-cyclical in recent years. As a result, the visibility of the years after 2022 in the order book have diminished slightly. At the same time, we saw a continued increase in the number of maintenance contracts and asset management projects, which has increased the share of our recurring business.

Significant new projects in 2021 included the revitalisation of Rabobank’s head office in Utrecht, the renovation of the Binnenhof (Dutch Houses of Parliament), the Ministry of Public Works and Waterways contract for the replacement of the traffic systems and lighting for the central and southern regions of the Netherlands, the construction of 400 to 500 standardised government-regulated rental homes in the Eindhoven region and the second phase of the Science Campus of the University of Leiden.

| Financial calendar | |

|---|---|

|

Annual General Meeting Ex-dividend date Trading update Q1 Half year results Trading update Q3 |

12 April 2022 14 April 2022 29 April 2022 29 July 2022 3 November 2022 |