Highlights:

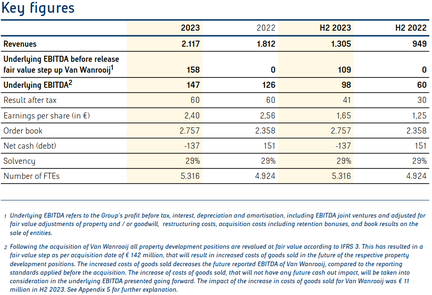

- Revenue rises to € 2.1 billion, including four months of Van Wanrooij (2022:€ 1.8 billion, organic growth: 10.0%)

- Underlying EBITDA increases from € 126 million to € 147 million (margin 6.9%, including Van Wanrooij)

- Net result comes in at € 60 million in 2023; dividend proposal € 0.89 per share (40% pay-out)

- Order book rises to € 2.8 billion (2022: € 2.4 billion)

- Solvency remains at robust level of 29% after Van Wanrooij acquisition (2022: 29%)

- Net debt € 137 million, on track to regain positive net cash position by 2026

- Sales ofhomes improves as of Q4 2024;Heijmans Vastgoed 1,803 homes sold throughout 2023 (2022: 1,811)

- Outlook 2024: revenue € 2.5 billion in sight with underlying EBITDA margin of minimum 6.5%

Ton Hillen, Heijmans CEO

“The past year was momentous for Heijmans in many ways. The grand celebration of our centenary was a wonderful milestone. It was with pride and gratitude that we were able to add the Royal predicate to our company name. This is a crowning achievement for us and for so many generations before us. We have worked with passion and conviction to make Heijmans’ mark visible right across the country in those 100 years.

As creators of the healthy living environment, we are now determined to continue to do so. In addition, the acquisition of Van Wanrooij’s development and construction business was a significant milestone for Heijmans in 2023.The market conditions in which we announced this acquisition were quite challenging. But with the further increasing scarcity on the housing market, we explicitly made this transaction with a view to the medium term. We already see the first signs of recovery in the housing market since the fourth quarter of 2023. At Heijmans Property Development, this resulted in total homes sales of 1,803 homes for the full year 2023, which was at a similar level to 2022. Together with Van Wanrooij, we sold 2,579 homes. This was a clear indication of the growing demand for houses in suburban locations.

We also enjoyed good and predictable financial results in 2023, despite a dip in the housing market that was felt the most at Property Development. However, Building & Technology and our Infra business more than offset for this decline in revenue. We are positive about the future, with a rising order book, which brings annual revenue of € 2.5 billion in sight in 2024. The outlook for Building & Technology and Infra remains strong. We also expect to see a recovery in the housing market, putting us in an excellent position for continued result growth with Heijmans Property Development and Van Wanrooij,with a total land bank of approximately 30,000 homes, it is ideally positioned for further growth in results."

Safety

At Heijmans we have long been committed to permanently improving safety in the construction industry. Broad awareness of this and a shared sense of urgency are our top priority. On the so-called Safety Culture Ladder (SCL), we have now reached level 4 (of 5 in total) for the whole of Heijmans, excluding recently acquired companies. Naturally, we are proud of this, but there is still work to do. We were deeply affected by a traffic accident with one fatality on the Gorinchem - Waardenburg (dyke reinforcement) consortium project in 2023, and this reminded us once again of the absolute necessity for us to continue to improve safety. We are therefore putting all our focus on preventing dangerous situations, with the emphasis on behaviour and the tightening and compliance of the procedures is central.

Sustainability

We take our social responsibility extremely seriously. Improving sustainability plays a leading role on this front and has now been an integral part of our strategy for several years. This is visible in every aspect of our work. In 2023, we also managed to make progress on the crucial themes of climate, circularity, biodiversity and nature-inclusive construction.

We want to remain at the forefront of the ongoing green transition. This is why last year we invested € 12 million in electric equipment. We welcome the increasing focus on sustainability in tender principles according to the Most Economically Advantageous Tender (Dutch: EMVI). This is essential if we are to make the required investments in sustainable construction economically viable too. In addition, we are seeing an increase in the generation of data throughout the chain and that certainly includes data on every aspect of sustainability. We also find this development encouragingand helps us achieve our sustainability ambitions.

Our ambition is to work entirely emission-free by 2030, i.e. without emitting CO as referred to in scope 1 & 2. That is quite a task, and not something we can achieve alone. For instance, the availability of electrified construction equipment is still inadequate, with grid congestion also an inhibiting factor for further investment. However, we are at the front of the queue as soon as deliveries are available again, and we are looking for creative solutions to convert our own equipment, improve sustainability and also supply construction sites with charging capacity for our electric equipment. A growing number of clients rightly set sustainability requirements when commissioning their projects.

We are directly affected by global climate change in our operational areas. We are seeing periods of extreme water surplus alternate with increasing drought and rising temperatures. This obviously has a major impact on the built environment and the way we build. For example, we are increasingly looking at ways to capture and store water, as in our project Hart van Zuid in Rotterdam. This results in a transformation from a fossilized to an adaptive city. In this crucial area, we prefer to look for cooperation, as we did for instance in our recent affiliation with the WaterBank platform.

Outlook 2024

Heijmans is confident about the future. As a centrally organised player, Heijmans is in an excellent position to provide solutions for the infrastructure, construction and property development challenges of today and tomorrow. Thanks to this strong positioning, combined with sound risk management and a diversified portfolio, we expect to outperform the outlook for the market as a whole. Our recalibrated strategic course puts an even stronger focus on looking to connect with clients when shaping solutions for complex building assignments, taking into account the impact of various major societal themes. We started 2024 with a well-filled order book, which, as in previous years, continued to grow and in qualitative terms gives us a solid basis to meet our return targets. Building & Technology and Infra have both seen an increase in the share of recurring business in management and maintenance. This gives us a much clearer picture of revenue and result development for 2024 and we expect further growth in both business areas this year. We are also positive about Heijmans Property Development and Van Wanrooij, as we are confident about the housing market. This confidence is backed up by the increasing home sales over the past five months, especially in suburban areas. Partly thanks to the acquisition of Van Wanrooij, Heijmans is in a good position in the housing market. The pick-up in home sales in particular is expected to result in healthy growth in revenue and profit after 2024.

Sales growth will continue in 2024, partly because Van Wanrooij will be included in the figures for the full year, bringing the € 2.5 billion mark in sight. We are targeting an underlying EBITDA margin of minum 6.5% for 2024, partly driven by Van Wanrooij, where we expect an underlying EBITDA contribution of € 30 to € 50 million in 2024, after taking into account the purchase price allocation of approximately € 20 million has been allocated. At the time of the Van Wanrooij acquisition, we stated that we wanted to return to a net cash position by the end of 2026. We expect to take a good step in that direction this year thanks to a clearly positive cash flow. In addition, for 2024 we are targeting a solvency ratio higher than 30% and a leverage ratio (net debt/underlying EBITDA) that remains well below 1.0.

Financial calender

| 2024 | Activities |

|---|---|

| 1 March | Publication annual report 2023 |

| 30 April | Annual General Meeting Heijmans N.V. |